Indian Mogul Rises to Status Of Money Icon Hunt for Undervalued Now Goes to the Mall; Like Warren Buffett

by Diya Gullapalli - Wall Street Journal - January 13, 2007 (Direct Link)

Mumbai, India -- Rakesh Jhunjhunwala, often referred to as "India's Warren Buffett," built his fortune over the past 20 years by shopping for undervalued local companies. Now he's shopping for shopping malls.

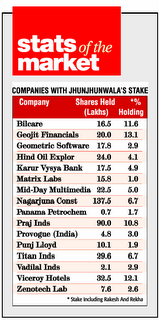

He is keen on the malls, and the consumer goods flying off the shelves there. There is "a big explosion of purchases in India," especially in areas like construction and jewelry, he said recently, sitting in his 15th-floor office here in Mumbai, India's financial capital, his back to the Arabian Sea just beyond the window.Mr. Jhunjhunwala, a chain-smoking, diamond-ring-wearing 46-year-old money manager, is idolized in India by millions of small investors who dream of following in his footsteps. He is a fixture on Indian television, talking up his bull-market views, and on the lecture circuit -- addressing groups like the "Millennium Mams," an organization targeting housewives who want to learn about business. He makes headlines when buying 2% of a company's shares, sits on 10 boards of directors, and regularly finds fellow investors chasing his stock picks.

His investments map the arc of India's recent economic emergence. The son of a tax commissioner, Mr. Jhunjhunwala says he toyed with becoming a pilot but went into accounting instead. In the mid-1980s, he began playing the market with 5,000 rupees (just over $100 at today's exchange rates), and never looked back. One of his first investments: Tata Tea Ltd., which quickly took off. (Years later, Tata Tea would acquire British tea giant Tetley.) He subsequently moved into mining, where he made his first million rupees in iron-ore exporter Sesa Goa.

In this nation of castes and sometimes rigid tradition that can limit social and economic mobility, his is a relatively unusual story of self-created wealth. Today, he has amassed a $700 million fortune. While that pales in comparison with the real Buffetts of the world, it's a fortune in a country where average annual income is measured in hundreds of dollars. Mr. Buffett's fortune has been valued at more than $40 billion, though he is giving away big chunks of that to charity. Like India's stock market itself, Mr. Jhunjhunwala has had his share of setbacks. Last year, the Securities and Exchange Board of India cleared him and his wife in an investigation into stock-price manipulation. The case dealt with how some big trades from his firm a few years ago affected stock prices.

Mr. Jhunjhunwala's colleague, Utpal Sheth, says they are pleased with the outcome of the case and found regulators "sensible and fair." Mr. Jhunjhunwala certainly isn't the only Indian investor to benefit from the run-up in local markets in recent years. Many other value investors there have also become famous for spotting cheap stocks. And last May, when the Bombay Stock Exchange's benchmark 30-stock Sensitive Index, or Sensex, plunged amid a sharp retreat in emerging-markets stocks world-wide, Mr. Jhunjhunwala's portfolio tumbled along with it. He endured another big hit just a few weeks ago, when a dramatic downturn in Thailand's stock market rippled through India's market as well. Local newspapers blared headlines like "Blood Baht in Thai markets," a reference to a decline in Thailand's currency, the baht. India's shares fell 3% that day. The next day Mr. Jhunjhunwala, sitting in front of five computer screens in his office in the Nariman Point financial district, scribbled trades in a small notebook and barked orders to his assistants in Hindi to fetch tea and sell some shares.

"The market is on the weaker side today," Mr. Jhunjhunwala muttered -- an understatement -- sitting with his collared shirt untucked.

As the day unfolded, he found time to eat an elaborate Indian lunch and chat with a friend about bringing a bottle of whiskey that weekend to his house in the hills outside of Mumbai, formerly Bombay, which features a karaoke studio and gym. In his office, his assistants serve drinks on coasters printed with a quote stressing the importance of integrity and hard work that is attributed to John Bogle, Vanguard Group's founder. Displayed nearby are images of Hindu deities, as well as sketches of billionaires Mr. Buffett and George Soros. He built his private investment company, Rare Enterprises (the name merges the "Ra" from his first name with "Re" from his wife's name, Rekha), by investing mostly in smaller Indian stocks. His rise has differed from other Indian investing icons who made their names through speculation and fraud during the technology bubble of the 1990s.

One of his best recent moves was selling part of his stake in Indian rating company Crisil Ltd. to McGraw-Hill Cos.' Standard & Poor's Corp. for more than four times what he bought it for. S&P acquired a majority stake in the company last year. These days he is buying land in the south India city of Secunderabad, where he plans to build shopping malls, and backs private equity and other investments in a dredging firm, a radio station, a school and a security company.

"In Mumbai, he's very widely known" as a "bit of a blunt guy," says Pradeep Dokania, head of the global private-client group for DSP Merrill Lynch. However, "sometimes people may feel he's overconfident" about the markets. So far, his optimism has paid off. The Sensex has quadrupled in the past five years, and such growth is attracting foreigners. In just the past week, New York Stock Exchange parent NYSE Group Inc. and others said that they are buying a stake in India's National Stock Exchange.

And Mr. Jhunjhunwala is sticking to his guns. By 2010, he predicts India's gross domestic product growth will have hit 10% for at least one year. In a slide show that outlines his investment philosophies, he says: The bull market in India "will really need God's wrath for it to be reversed prematurely."