Market Risk & Time

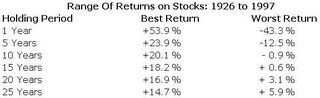

For example, a one-year investment in stocks has historically produced returns ranging from +53.9% to -43.3%. Over ten-year periods, however, returns have varied from -0.9% per year for the worst ten years to +20.1% per year for the best ten years.

As you can see, risk can be substantial over short periods. But over longer horizons, the chance of losing money is substantially reduced.

The same principle applies to bonds, though bonds are less risky than stocks. For long-term bonds, it takes ten years before returns are consistently positive; for shorter-maturity bonds, about three years.

Of course, it should be noted that past performance in the stock and bond markets does not necessarily predict future performance.