Investing

is most intelligent when it is most businesslike - Benjamin Graham (1894-1976)

____________________________________________________________________

Value-Stock-Plus stands at No. 50 in the

list of Top 100 Finance

Blogs by ValueWiki

Recognised by

The Economic Times as one of the most

popular financial blog

Updated! Compilation on

Warren Buffett,

Rakesh Jhunjhunwala

& Charlie Munger

____________________________________________________________________

« Home | When stock market returns lie! » | Happy Holi! » | (must read!) India: Cyclical vs. Structural » | Indian Organized Retail: ‘Fair’re‘tale’ by SSKI » | Follow FIIs, and mint money » | 'Market's over-bought' : Malcolm Wood » | Bull Markets & Scam: A view by Rakesh Jhunjhunwala » | `We never learn from the past completely' : Aswath... » | Cautious over markets in short-term: Morgan Stanley » | Short-term rate signals »

Source: DNA Money/ Mobis Philipose

What if an accountant told you that the profit earned by most Indian companies doesn’t give the true picture, and that in fact the profit level of most companies are much lower than what they’re shown to be?

Well, that looks like a sure recipe for disaster as far as the stock markets go, especially considering that price-earnings valuations are stretched even after using reported (or should one say bloated?) profit figures. But that’s exactly what Global Data Services of India Ltd (GDSIL), an accounting analysis firm set up by Crisil, says in its recently issued report, “Accounting & Analysis - The Indian Experience”.

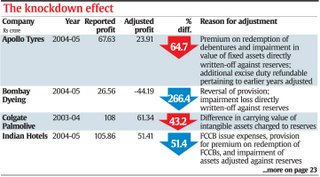

GDSIL analyses published accounts of Indian companies, and reclassifies numbers both from the balance sheet and the profit and loss account in order to present them in a standardised format. This is done primarily to point out the difference in profit arising through the use of clever accounting tricks. The table alongside shows how the profit of major companies would reduce substantially (in some cases, a reportedly profitable company turns into a loss-making one) if they were to follow prudent accounting policy. In a majority of cases, it has been seen that companies write-off huge expenses against reserves in the balance sheet, thereby boosting profit. This goes against prudent accounting practices. Madhu Dubhashi, chief executive officer of GDSIL, explains, “Any item that a company spends money on must finally get reflected in one way or the other in the profit & loss account. This could be by means of depreciation, amortisation, write-offs or as provisions.”

For instance, if an investment made by a company at Rs 100 is sold for Rs 60, then the loss of Rs 40 must ideally be reflected in the profit & loss account. Some companies adjust this loss against reserves in the balance sheet, thereby skewing the picture to that extent. It’s not just loss on investments; companies such as Tata Motors have written off deferred expenses such as product development expenses against reserves in the past.

In this case, the concerned amount should have been reflected in the profit & loss account through amortisation, which would give a correct picture of the profitability. Tata Motors, for instance, continues to profit from the products it had developed through the use of the ‘product development expenses’ account. The fact that these expenses are not factored in the profit and loss account appropriately means that the ‘profit’ picture is incorrect. Tata Motors is only a case in point. There are over a 100 companies in which GDSIL has found the reported profit to be higher than what it should have been.

Writing expenses off against reserves in the balance sheet is a convenient way of boosting profit levels (as is apparent from the table), since they would never find their way into the profit and loss account. It’s important to note that accounting standards that are prescribed in India do not permit a write-off of expenses (except preliminary expenses and certain expenses related to the issue of securities) against reserves.

Most times, companies write off expenses against reserves through high court approvals using a special resolution for reduction of share capital under section 100 of the Companies Act. The GDSIL report notes that the trend of direct write-offs against reserves is a dangerous one the reported earnings per share can be a misleading indicator of the profitability of a company. Worse still, companies like Bombay Dyeing have taken the benefit of the reversal of these write-offs in the profit and loss account, according to GDSIL.

Not only did it deduct expenses directly from reserves, but when these expenses were written back (reversed), they were routed through the profit and loss account. Bombay Dyeing’s profit after tax of Rs 27 crore in financial year 2004-05 included a gain of Rs 17 crore from such a reversal. This is a clear case of showing fictitious profit, where none exists, says the report.

Source: DNA Money/ Mobis Philipose

What if an accountant told you that the profit earned by most Indian companies doesn’t give the true picture, and that in fact the profit level of most companies are much lower than what they’re shown to be?

Well, that looks like a sure recipe for disaster as far as the stock markets go, especially considering that price-earnings valuations are stretched even after using reported (or should one say bloated?) profit figures. But that’s exactly what Global Data Services of India Ltd (GDSIL), an accounting analysis firm set up by Crisil, says in its recently issued report, “Accounting & Analysis - The Indian Experience”.

GDSIL analyses published accounts of Indian companies, and reclassifies numbers both from the balance sheet and the profit and loss account in order to present them in a standardised format. This is done primarily to point out the difference in profit arising through the use of clever accounting tricks. The table alongside shows how the profit of major companies would reduce substantially (in some cases, a reportedly profitable company turns into a loss-making one) if they were to follow prudent accounting policy. In a majority of cases, it has been seen that companies write-off huge expenses against reserves in the balance sheet, thereby boosting profit. This goes against prudent accounting practices. Madhu Dubhashi, chief executive officer of GDSIL, explains, “Any item that a company spends money on must finally get reflected in one way or the other in the profit & loss account. This could be by means of depreciation, amortisation, write-offs or as provisions.”

For instance, if an investment made by a company at Rs 100 is sold for Rs 60, then the loss of Rs 40 must ideally be reflected in the profit & loss account. Some companies adjust this loss against reserves in the balance sheet, thereby skewing the picture to that extent. It’s not just loss on investments; companies such as Tata Motors have written off deferred expenses such as product development expenses against reserves in the past.

In this case, the concerned amount should have been reflected in the profit & loss account through amortisation, which would give a correct picture of the profitability. Tata Motors, for instance, continues to profit from the products it had developed through the use of the ‘product development expenses’ account. The fact that these expenses are not factored in the profit and loss account appropriately means that the ‘profit’ picture is incorrect. Tata Motors is only a case in point. There are over a 100 companies in which GDSIL has found the reported profit to be higher than what it should have been.

Writing expenses off against reserves in the balance sheet is a convenient way of boosting profit levels (as is apparent from the table), since they would never find their way into the profit and loss account. It’s important to note that accounting standards that are prescribed in India do not permit a write-off of expenses (except preliminary expenses and certain expenses related to the issue of securities) against reserves.

Most times, companies write off expenses against reserves through high court approvals using a special resolution for reduction of share capital under section 100 of the Companies Act. The GDSIL report notes that the trend of direct write-offs against reserves is a dangerous one the reported earnings per share can be a misleading indicator of the profitability of a company. Worse still, companies like Bombay Dyeing have taken the benefit of the reversal of these write-offs in the profit and loss account, according to GDSIL.

Not only did it deduct expenses directly from reserves, but when these expenses were written back (reversed), they were routed through the profit and loss account. Bombay Dyeing’s profit after tax of Rs 27 crore in financial year 2004-05 included a gain of Rs 17 crore from such a reversal. This is a clear case of showing fictitious profit, where none exists, says the report.

Source: DNA Money/ Mobis Philipose

What if an accountant told you that the profit earned by most Indian companies doesn’t give the true picture, and that in fact the profit level of most companies are much lower than what they’re shown to be?

Well, that looks like a sure recipe for disaster as far as the stock markets go, especially considering that price-earnings valuations are stretched even after using reported (or should one say bloated?) profit figures. But that’s exactly what Global Data Services of India Ltd (GDSIL), an accounting analysis firm set up by Crisil, says in its recently issued report, “Accounting & Analysis - The Indian Experience”.

GDSIL analyses published accounts of Indian companies, and reclassifies numbers both from the balance sheet and the profit and loss account in order to present them in a standardised format. This is done primarily to point out the difference in profit arising through the use of clever accounting tricks. The table alongside shows how the profit of major companies would reduce substantially (in some cases, a reportedly profitable company turns into a loss-making one) if they were to follow prudent accounting policy. In a majority of cases, it has been seen that companies write-off huge expenses against reserves in the balance sheet, thereby boosting profit. This goes against prudent accounting practices. Madhu Dubhashi, chief executive officer of GDSIL, explains, “Any item that a company spends money on must finally get reflected in one way or the other in the profit & loss account. This could be by means of depreciation, amortisation, write-offs or as provisions.”

For instance, if an investment made by a company at Rs 100 is sold for Rs 60, then the loss of Rs 40 must ideally be reflected in the profit & loss account. Some companies adjust this loss against reserves in the balance sheet, thereby skewing the picture to that extent. It’s not just loss on investments; companies such as Tata Motors have written off deferred expenses such as product development expenses against reserves in the past.

In this case, the concerned amount should have been reflected in the profit & loss account through amortisation, which would give a correct picture of the profitability. Tata Motors, for instance, continues to profit from the products it had developed through the use of the ‘product development expenses’ account. The fact that these expenses are not factored in the profit and loss account appropriately means that the ‘profit’ picture is incorrect. Tata Motors is only a case in point. There are over a 100 companies in which GDSIL has found the reported profit to be higher than what it should have been.

Writing expenses off against reserves in the balance sheet is a convenient way of boosting profit levels (as is apparent from the table), since they would never find their way into the profit and loss account. It’s important to note that accounting standards that are prescribed in India do not permit a write-off of expenses (except preliminary expenses and certain expenses related to the issue of securities) against reserves.

Most times, companies write off expenses against reserves through high court approvals using a special resolution for reduction of share capital under section 100 of the Companies Act. The GDSIL report notes that the trend of direct write-offs against reserves is a dangerous one the reported earnings per share can be a misleading indicator of the profitability of a company. Worse still, companies like Bombay Dyeing have taken the benefit of the reversal of these write-offs in the profit and loss account, according to GDSIL.

Not only did it deduct expenses directly from reserves, but when these expenses were written back (reversed), they were routed through the profit and loss account. Bombay Dyeing’s profit after tax of Rs 27 crore in financial year 2004-05 included a gain of Rs 17 crore from such a reversal. This is a clear case of showing fictitious profit, where none exists, says the report.

Source: DNA Money/ Mobis Philipose

What if an accountant told you that the profit earned by most Indian companies doesn’t give the true picture, and that in fact the profit level of most companies are much lower than what they’re shown to be?

Well, that looks like a sure recipe for disaster as far as the stock markets go, especially considering that price-earnings valuations are stretched even after using reported (or should one say bloated?) profit figures. But that’s exactly what Global Data Services of India Ltd (GDSIL), an accounting analysis firm set up by Crisil, says in its recently issued report, “Accounting & Analysis - The Indian Experience”.

GDSIL analyses published accounts of Indian companies, and reclassifies numbers both from the balance sheet and the profit and loss account in order to present them in a standardised format. This is done primarily to point out the difference in profit arising through the use of clever accounting tricks. The table alongside shows how the profit of major companies would reduce substantially (in some cases, a reportedly profitable company turns into a loss-making one) if they were to follow prudent accounting policy. In a majority of cases, it has been seen that companies write-off huge expenses against reserves in the balance sheet, thereby boosting profit. This goes against prudent accounting practices. Madhu Dubhashi, chief executive officer of GDSIL, explains, “Any item that a company spends money on must finally get reflected in one way or the other in the profit & loss account. This could be by means of depreciation, amortisation, write-offs or as provisions.”

For instance, if an investment made by a company at Rs 100 is sold for Rs 60, then the loss of Rs 40 must ideally be reflected in the profit & loss account. Some companies adjust this loss against reserves in the balance sheet, thereby skewing the picture to that extent. It’s not just loss on investments; companies such as Tata Motors have written off deferred expenses such as product development expenses against reserves in the past.

In this case, the concerned amount should have been reflected in the profit & loss account through amortisation, which would give a correct picture of the profitability. Tata Motors, for instance, continues to profit from the products it had developed through the use of the ‘product development expenses’ account. The fact that these expenses are not factored in the profit and loss account appropriately means that the ‘profit’ picture is incorrect. Tata Motors is only a case in point. There are over a 100 companies in which GDSIL has found the reported profit to be higher than what it should have been.

Writing expenses off against reserves in the balance sheet is a convenient way of boosting profit levels (as is apparent from the table), since they would never find their way into the profit and loss account. It’s important to note that accounting standards that are prescribed in India do not permit a write-off of expenses (except preliminary expenses and certain expenses related to the issue of securities) against reserves.

Most times, companies write off expenses against reserves through high court approvals using a special resolution for reduction of share capital under section 100 of the Companies Act. The GDSIL report notes that the trend of direct write-offs against reserves is a dangerous one the reported earnings per share can be a misleading indicator of the profitability of a company. Worse still, companies like Bombay Dyeing have taken the benefit of the reversal of these write-offs in the profit and loss account, according to GDSIL.

Not only did it deduct expenses directly from reserves, but when these expenses were written back (reversed), they were routed through the profit and loss account. Bombay Dyeing’s profit after tax of Rs 27 crore in financial year 2004-05 included a gain of Rs 17 crore from such a reversal. This is a clear case of showing fictitious profit, where none exists, says the report.

can u tell where this information is available

Posted by M B Mahesh |

4:07 AM

M B Mahesh |

4:07 AM