More than any stock pick, daughter Nishtha gets Jhunjhunwala’s undivided attention these days. Born after 18 years of marriage, her arrival has changed his outlook to life, says Priya Singh.

Housewives in surburban Andheri, hooked to the stockmarket ticker, swoon at the mention of his name. Billed by the financial media as the Pied Piper of the Indian bourses, it is not unusual for owners and CEOs of India’s leading companies to drop into his Nariman Point office, funding proposals in hand, for a coffee and a chat. Yet, Rakesh Jhunjhunwala, the man who built a gigantic fortune single-handedly during a 21-year relationship with the manic equity markets, is an ordinary man who found his calling early in his life and has pursued it well.

Ask him how wealth has changed his lifestyle, and Jhunjhunwala says: “From smoking Four Square cigarettes, I have graduated to 555s; from drinking Royal Challenge whisky, I have switched to Black Label and instead of a Maruti 800, I now own a Mercedes S-Class.” Despite the Rs 1,735.86 crore that places him in the BW Billionaires’ listing, Jhunjhunwala has clung to his upper middle class roots. He still lives in his family home at Walkeshwar in downtown Mumbai. He bought his first property — a holiday home in nearby Lonavala — only in his 40s. His family doesn’t go to London and Paris every summer, like other Indian entrepreneurs and corporate chieftains. His last vacation was in Kashmir. And he still vividly recalls spending Rs 7,000 on an outfit for his wife.

It is quite apparent that he is no big spender, a trait corroborated by his wife, Rekha. “He is really careful with his money, but he doesn’t stop me from spending it,” she smiles. Jhunjhunwala is quick to retort with an indulgent smile at his spouse: “I want to live in peace.” The spark between the two is very much there. Jhunjhunwala considers Rekha his lucky mascot, and often buys stocks for her, besides spoiling her silly on birthdays by renting nightclubs and DJs. But even then, the middle class gene kicks in — the value-for-money man heads to Tanishq, a brand known for its quality, to buy her jewels. So, if money isn’t the driving force behind him, what makes him one of India’s canniest value investors? Our bet is that the man seeks excitement. For him, the adrenalin rush of the market is vital. And since he is not into car racing or flying in air balloons, the stockmarket is a perfect alternative for the man who says: “Life is a gamble.” He has been obsessed with stock prices and balance sheets since boyhood. “The market was, is and will be his only passion,” says Rekha, recalling how her father-in-law had to shut down a crown caps manufacturing facility in Hyderabad as Rakesh refused to run it. Instead, after completing his chartered accountancy in 1985, he headed for the stockmarket.

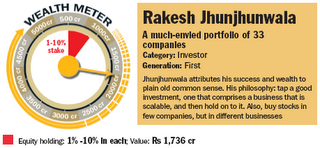

The early days were tough, but Jhunjhunwala was unfazed. He wanted to be an independent professional and not kowtow to a corporate management team. “In 1986, I made my first big profit of Rs 15 lakh by selling 5,000 Tata Tea shares, which I bought for Rs 43 each, at Rs 140 in three months.” Jhunjhunwala attributes his success to plain old common sense rather than intelligence. “You have to tap a good investment, one that comprises a business that is scalable, and then just hold on to it,” he says. He has done just that with the Pantaloon stock, which he bought before the Indian markets took off and holds a 1.85 per cent stake valued at Rs 97.31 crore as on 31 March. He also believes in a diversified portfolio. “Buy few companies, but in different businesses,” he says. A look at his portfolio (as on 31 March, 2006) reveals that he has invested in industries like media, hotels, information technology, retail, pharmaceuticals, banking and FMCG (see tables).

Jhunjhunwala says it takes time to make money. “I made 50 per cent of my wealth in five years (remember he has been trading for over two decades).” Which five? Probably the last five years, though he ducks the question by saying that 2005 was a “bumper year”. For him, the excitement doesn’t end with hot stock picks. “He likes to party, either at home or outside,” says Rekha. He is often seen with family and friends at his favourite haunts among the city’s eateries and lounges. He even has a full-fledged discotheque in his Lonavala home for his weekends there.

Despite the hectic socialising, Jhunjhunwala is a workaholic and his eyes are glued to the screen practically 24 hours. Stockmarket reporters will tell you of interviews with him, during which he keeps a close eye on the ticker and business news, and makes deals at the same time. His other obsession is his two year-old daughter, Nishtha, born to the couple after 18 years of marriage. “He wants to drop her to school at 9 a.m. and then go to work, despite wrapping up the day at 10 p.m. I often bring her to his office so that he can spend time with her,” says Rekha. The birth of his daughter has also kindled an interest in philanthropy. Jhunjhunwala proudly displays a model of a 57,000-sq. ft complex in Panvel that will house 400 homeless children. “For our daughter’s first birthday party, we invited 500 underprivileged children to Bowling Co. (in mid-town Parel),” says Rekha.

There is, thus, a soft side to the successful investor. “When I think of Rakesh Jhunjhunwala, I think of Crisil. He got Standard & Poor’s (S&P) to pay Crisil the right price,” says the head of an Indian private equity fund. (In 2005, S&P, through an open offer, became a majority shareholder in Crisil, where Jhunjhunwala had an over 14 per cent stake. He still retains about 5 per cent.) “I see no reason why he will not continue to be one of the country’s large private investors,” she adds.

The housewives in suburban Andheri will agree.

Source: BWI

Additional Link:

![]()

Why had RJ bought tata tea in 1986

Posted by DDR |

1:19 PM

DDR |

1:19 PM