Unitech’s unreal rise

But the market is obviously not differentiating between plans and their execution. Given growing protests over SEZs, the need for environmental clearance and permission for conversion of agriculture land to non-agriculture use, real estate investment experts do not rule out delays. CLSA estimates that every six months of average delay will change the NPV by Rs 35 per share.

Secondly, any significant increase in interest rates can also dampen demand for homes, which is a large contributor to Unitech’s revenues. Lastly, if real estate prices cool off from their current high levels, it will lead to lower profits for the real estate division, which accounted for 54.6% of total segmental profits in 2005-06. As per CLSA estimates, a 1% change in selling prices will lead to a 2% change in NPV per share. Rising real estate prices (during the last two years) have helped consolidated profit margins for the real estate division jump from 7.7% in 2003-04 to 22% in 2005-06. The construction division’s margins rose from 8.5% to 13% during this period.

Unitech’s plans, which involve completing most of its projects (excluding SEZs) by 2013, translate to construction of an average 66 MSF annually for the next seven years. Contrast this with the fact that the company has developed just over 10 MSF and about 1,000 acres in plots during the last 20 years. Also, compare this with 28 MSF of constructed area (residential, commercial and retail) delivered in Mumbai (including Thane and New Mumbai) and 20 MSF in Pune during 2005-06. Are the markets listening?

Source: DNA Money

Capital goods: Look before you leap!

Growth in user industries like power, construction, refining, textiles, automobiles, and other manufacturing, has led to strong performance by the Indian capital goods and heavy industries companies in the past 2-3 years. Apart from creating sufficient domestic supplies, the growth in capacity expansion and improvement in productivity levels has also led to these companies charting a more confident global route than ever before. In fact, as per the Engineering Exports Promotion Council of India, India's heavy industrial and capital goods exports, which have grown at a compounded rate of 32% during the period FY01 to FY05, are estimated to grow at a rate of 25% per annum during the period FY04 to FY09.

Growth in user industries like power, construction, refining, textiles, automobiles, and other manufacturing, has led to strong performance by the Indian capital goods and heavy industries companies in the past 2-3 years. Apart from creating sufficient domestic supplies, the growth in capacity expansion and improvement in productivity levels has also led to these companies charting a more confident global route than ever before. In fact, as per the Engineering Exports Promotion Council of India, India's heavy industrial and capital goods exports, which have grown at a compounded rate of 32% during the period FY01 to FY05, are estimated to grow at a rate of 25% per annum during the period FY04 to FY09.

However, do these statistics and growth prospects definitely mean that investors should be blindfolded in their approach to investing in stocks from the sector? Not really!

While we have a positive view on the sector in terms of improving revenue visibility on the back of burgeoning order books of players across the sector, which is a consequence of the huge investment plans from public and private sector enterprises, there are a host of risks that surround these companies' prospects.

Over the past few years, considering the huge opportunity that the sector brings along, there has been a multi-layer increase in the number of participants in the capital goods and heavy engineering sector - multi-layer because the increase has been seen across the spectrum pf projects and heavy equipment segments. This has led to an increase in 'commoditisation' of the industry, whereby companies are fighting for volumes by sacrificing profitability. Even the best and most diverse of the companies have not been able to perk up their margins significantly in the past two years. While higher input prices are definitely a reason for lacklustre margin profile of many of these companies, there is no denying the fact that commoditisation has taken a serious toll across sub-segments, be it infrastructure creation, or power.

Another negative offshoot of the business opportunity has been increasing challenges for companies on the employee acquisition and retention front. Some of the companies have even indicated of attrition levels of 10% to 15%, which, unless clarified, might seem like employee churn in the IT services and BPO industry. Some critical divisions of these companies, like design and project execution, are in fact facing the biggest crunch in terms of talent acquisition and retention. And, apart from rise in employee costs, this has led to a big part of the crucial management time getting diverted to human resource issues.

Finally, as a flip side to the 'high visibility' factor in terms of burgeoning order books, there emerge equally high levels of high execution risks. This is because companies from the sector are increasingly adding contracts that have long gestation periods, or long execution cycles. Among many, this leads to risks from changes in business climate and uncertain movement of commodity prices.

And, what about valuations? Well, this is one of the foremost concerns that we have with the capital goods/heavy engineering stocks. With some of the leading companies trading at price to earnings multiple of as high as 40 times trailing twelve months' earnings, despite factoring in all kinds of positives like visibility and improved execution capabilities, we are uncomfortable with respect to the overall sector valuations.

Well, this is one of the foremost concerns that we have with the capital goods/heavy engineering stocks. With some of the leading companies trading at price to earnings multiple of as high as 40 times trailing twelve months' earnings, despite factoring in all kinds of positives like visibility and improved execution capabilities, we are uncomfortable with respect to the overall sector valuations.

As indicated above, apart from the 'visibility' part (as seen from big order bookings), investors need to clearly understand the risks associated with the same. While the need to sustain high levels of growth through creation of world-class infrastructure facilities shall continue to provide companies from the sector with multiple growth options, you, as an investor, need to identify whether the price that needs to be paid for the ensuing growth is justifiable or not.

Source: EM

Additional Readings:- Ethanol: A global perspective

- Software companies: Sensitive to the currency!

- Penny scrips lose way on Street

- Low buying conviction in evidence

- Bankex hits new high on better treasury show

- Promoters up stake in RIL by 2 pc

- What constitutes a wrong investment?

- End sops, allow free trade: Manmohan

- Easing out retail investors will be a setback

- Are valuations for banking stocks still attractive?

- Is this a broad-based rally? Will it fizzle out?

- Brokers bullish on Orient Paper, Ranbaxy, IVRCL

- John Maynard Keynes essentially said, don't try and figure out what the market is doing. Figure out a business you understand, and concentrate. - Warren Buffett

Mid cap stocks are generally more risky than large cap stocks and less risky than small caps. It has been seen in the past that risk of failure decreases as companies grow in size. As they grow large, they enjoy better bargaining power with suppliers and customers (except companies in a regulated industry like power and fertilisers) and have stronger systems in place with respect to tackling competitive forces. On the contrary, as companies grow large in size, their growth gets saturated (due to a high base effect), thus under performing the much smaller mid-size companies, which have room to grow into large ones. As such, when considering an investment in a mid cap stock, you need to decide if the stock in question has the potential to grow into a larger company. If you are right in your analysis and follow your action of investing into the stock, you will have a successful investment.

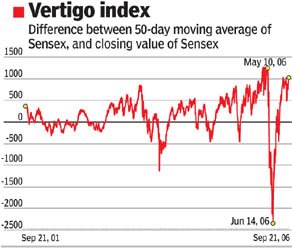

Mid cap stocks are generally more risky than large cap stocks and less risky than small caps. It has been seen in the past that risk of failure decreases as companies grow in size. As they grow large, they enjoy better bargaining power with suppliers and customers (except companies in a regulated industry like power and fertilisers) and have stronger systems in place with respect to tackling competitive forces. On the contrary, as companies grow large in size, their growth gets saturated (due to a high base effect), thus under performing the much smaller mid-size companies, which have room to grow into large ones. As such, when considering an investment in a mid cap stock, you need to decide if the stock in question has the potential to grow into a larger company. If you are right in your analysis and follow your action of investing into the stock, you will have a successful investment.  The theory of reversion to the mean suggests that the Bombay Stock Exchange Sensex should see some kind of correction soon. According to the hypothesis, the more the moving average of the Sensex shifts away from the index’s closing value as on that date, the sharper will be its drop.

The theory of reversion to the mean suggests that the Bombay Stock Exchange Sensex should see some kind of correction soon. According to the hypothesis, the more the moving average of the Sensex shifts away from the index’s closing value as on that date, the sharper will be its drop.

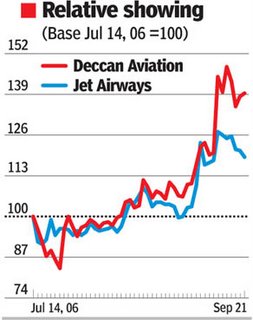

The market may be celebrating the fall of high-priced oil a bit too soon. In the aviation sector, most listed stocks have rebounded from their lows, when in fact falling oil prices may have only a small impact on margins in a scenario of hyper competition. With the domestic sector continuing to attract new players - Indigo Airlines was the latest to launch in August - the new entrants will have no option but to offer steep discounts to build marketshare. This will force the incumbents to continue cutting prices, effectively neutralising the benefits of lower oil prices.

Between early 2005 and March, 2006, the total number of airline seats offered in the domestic market has risen 55%, forcing a fare war. But costs have risen faster, which makes any rerating of the sector impossible for now despite lower oil prices. A look at Jet Airways’ last quarter numbers shows why. Even though net revenues grew 25.6%, overall expenditures rose twice as fast at 53.7%.

A large part of this was due to fuel (about a third), but the fastest growing cost is not fuel, but employee remuneration, which more than doubled (up 106.5%) due to a ramp-up of operations. The story is likely to be much the same in the rest of the aviation sector, thanks to the induction of new aircraft, investments in ground handling, and higher payments for aircraft rentals. Lease rentals grew at a zippy 70.7% for Jet, even as other operating expenses have risen to account for a quarter of total costs.

There is thus a strong possibility that the fall in oil prices will be more than compensated by rising costs of personnel, aircraft lease rentals, and interest costs. Jet, for example, had to shelve its plans to make a $800 million GDR/FCCB issue due to unsettled market conditions, choosing instead to borrow more from domestic banks at higher rates. With more than Rs 2,000 crore stuck in the aborted deal to buy Air Sahara, it is little wonder Edelweiss Securities has a clear sell on Jet. Since mid-July, Deccan Aviation has gained nearly 40%, Jet 19% and SpiceJet 18%, beating the BSE Sensex hollow (15%). The rally in aviation stocks is a bit premature, if not totally unreal.

The market may be celebrating the fall of high-priced oil a bit too soon. In the aviation sector, most listed stocks have rebounded from their lows, when in fact falling oil prices may have only a small impact on margins in a scenario of hyper competition. With the domestic sector continuing to attract new players - Indigo Airlines was the latest to launch in August - the new entrants will have no option but to offer steep discounts to build marketshare. This will force the incumbents to continue cutting prices, effectively neutralising the benefits of lower oil prices.

Between early 2005 and March, 2006, the total number of airline seats offered in the domestic market has risen 55%, forcing a fare war. But costs have risen faster, which makes any rerating of the sector impossible for now despite lower oil prices. A look at Jet Airways’ last quarter numbers shows why. Even though net revenues grew 25.6%, overall expenditures rose twice as fast at 53.7%.

A large part of this was due to fuel (about a third), but the fastest growing cost is not fuel, but employee remuneration, which more than doubled (up 106.5%) due to a ramp-up of operations. The story is likely to be much the same in the rest of the aviation sector, thanks to the induction of new aircraft, investments in ground handling, and higher payments for aircraft rentals. Lease rentals grew at a zippy 70.7% for Jet, even as other operating expenses have risen to account for a quarter of total costs.

There is thus a strong possibility that the fall in oil prices will be more than compensated by rising costs of personnel, aircraft lease rentals, and interest costs. Jet, for example, had to shelve its plans to make a $800 million GDR/FCCB issue due to unsettled market conditions, choosing instead to borrow more from domestic banks at higher rates. With more than Rs 2,000 crore stuck in the aborted deal to buy Air Sahara, it is little wonder Edelweiss Securities has a clear sell on Jet. Since mid-July, Deccan Aviation has gained nearly 40%, Jet 19% and SpiceJet 18%, beating the BSE Sensex hollow (15%). The rally in aviation stocks is a bit premature, if not totally unreal.