Since the start of 2006, companies with significant land banks have seen their stock prices soaring. The justification given is that the market value of the land these companies own is being factored into the price. A few of these companies do not have anything directly to do with the real estate business.

For example, Bombay Dyeing. Old textile mills sitting on large amounts of land have seen their stock prices go up by astonishing amounts. Swan Mills saw its prices treble in the last 80 days to Rs 3,190. Since June-end, the rate of rise has been more moderate for genuine real estate companies like Unitech, but even so their stocks have done better than the broader market.

It is worth noting that there are many companies that own lots of land. Infosys owns around 800 acres of land. State Bank of India (SBI) also owns a large amount of property, and so does ITC. A few years back analysts had come with a similar theory on the stock price of SBI being underpriced because it owned assets like property and flats in the posh areas of metropolitan India. Their market value should, therefore, be factored into the stock price, it was argued. That logic turned out to be specious because SBI may never put these properties on the market.

Before going gung-ho about any company that has some land on its books, investors need to figure out whether the land will ever be put on the market. And even if the answer is yes, whether it is worth paying price-earnings multiples in the range of 200-500 - as is the case with companies like Unitech and Swan.

Aviation Sector's Unreal rally

The market may be celebrating the fall of high-priced oil a bit too soon. In the aviation sector, most listed stocks have rebounded from their lows, when in fact falling oil prices may have only a small impact on margins in a scenario of hyper competition. With the domestic sector continuing to attract new players - Indigo Airlines was the latest to launch in August - the new entrants will have no option but to offer steep discounts to build marketshare. This will force the incumbents to continue cutting prices, effectively neutralising the benefits of lower oil prices.

Between early 2005 and March, 2006, the total number of airline seats offered in the domestic market has risen 55%, forcing a fare war. But costs have risen faster, which makes any rerating of the sector impossible for now despite lower oil prices. A look at Jet Airways’ last quarter numbers shows why. Even though net revenues grew 25.6%, overall expenditures rose twice as fast at 53.7%.

A large part of this was due to fuel (about a third), but the fastest growing cost is not fuel, but employee remuneration, which more than doubled (up 106.5%) due to a ramp-up of operations. The story is likely to be much the same in the rest of the aviation sector, thanks to the induction of new aircraft, investments in ground handling, and higher payments for aircraft rentals. Lease rentals grew at a zippy 70.7% for Jet, even as other operating expenses have risen to account for a quarter of total costs.

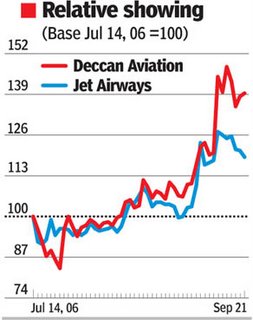

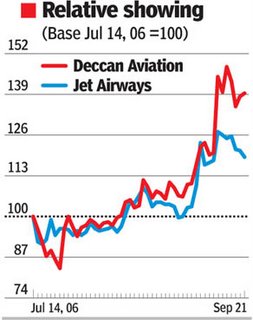

There is thus a strong possibility that the fall in oil prices will be more than compensated by rising costs of personnel, aircraft lease rentals, and interest costs. Jet, for example, had to shelve its plans to make a $800 million GDR/FCCB issue due to unsettled market conditions, choosing instead to borrow more from domestic banks at higher rates. With more than Rs 2,000 crore stuck in the aborted deal to buy Air Sahara, it is little wonder Edelweiss Securities has a clear sell on Jet. Since mid-July, Deccan Aviation has gained nearly 40%, Jet 19% and SpiceJet 18%, beating the BSE Sensex hollow (15%). The rally in aviation stocks is a bit premature, if not totally unreal.

The market may be celebrating the fall of high-priced oil a bit too soon. In the aviation sector, most listed stocks have rebounded from their lows, when in fact falling oil prices may have only a small impact on margins in a scenario of hyper competition. With the domestic sector continuing to attract new players - Indigo Airlines was the latest to launch in August - the new entrants will have no option but to offer steep discounts to build marketshare. This will force the incumbents to continue cutting prices, effectively neutralising the benefits of lower oil prices.

Between early 2005 and March, 2006, the total number of airline seats offered in the domestic market has risen 55%, forcing a fare war. But costs have risen faster, which makes any rerating of the sector impossible for now despite lower oil prices. A look at Jet Airways’ last quarter numbers shows why. Even though net revenues grew 25.6%, overall expenditures rose twice as fast at 53.7%.

A large part of this was due to fuel (about a third), but the fastest growing cost is not fuel, but employee remuneration, which more than doubled (up 106.5%) due to a ramp-up of operations. The story is likely to be much the same in the rest of the aviation sector, thanks to the induction of new aircraft, investments in ground handling, and higher payments for aircraft rentals. Lease rentals grew at a zippy 70.7% for Jet, even as other operating expenses have risen to account for a quarter of total costs.

There is thus a strong possibility that the fall in oil prices will be more than compensated by rising costs of personnel, aircraft lease rentals, and interest costs. Jet, for example, had to shelve its plans to make a $800 million GDR/FCCB issue due to unsettled market conditions, choosing instead to borrow more from domestic banks at higher rates. With more than Rs 2,000 crore stuck in the aborted deal to buy Air Sahara, it is little wonder Edelweiss Securities has a clear sell on Jet. Since mid-July, Deccan Aviation has gained nearly 40%, Jet 19% and SpiceJet 18%, beating the BSE Sensex hollow (15%). The rally in aviation stocks is a bit premature, if not totally unreal.

The market may be celebrating the fall of high-priced oil a bit too soon. In the aviation sector, most listed stocks have rebounded from their lows, when in fact falling oil prices may have only a small impact on margins in a scenario of hyper competition. With the domestic sector continuing to attract new players - Indigo Airlines was the latest to launch in August - the new entrants will have no option but to offer steep discounts to build marketshare. This will force the incumbents to continue cutting prices, effectively neutralising the benefits of lower oil prices.

Between early 2005 and March, 2006, the total number of airline seats offered in the domestic market has risen 55%, forcing a fare war. But costs have risen faster, which makes any rerating of the sector impossible for now despite lower oil prices. A look at Jet Airways’ last quarter numbers shows why. Even though net revenues grew 25.6%, overall expenditures rose twice as fast at 53.7%.

A large part of this was due to fuel (about a third), but the fastest growing cost is not fuel, but employee remuneration, which more than doubled (up 106.5%) due to a ramp-up of operations. The story is likely to be much the same in the rest of the aviation sector, thanks to the induction of new aircraft, investments in ground handling, and higher payments for aircraft rentals. Lease rentals grew at a zippy 70.7% for Jet, even as other operating expenses have risen to account for a quarter of total costs.

There is thus a strong possibility that the fall in oil prices will be more than compensated by rising costs of personnel, aircraft lease rentals, and interest costs. Jet, for example, had to shelve its plans to make a $800 million GDR/FCCB issue due to unsettled market conditions, choosing instead to borrow more from domestic banks at higher rates. With more than Rs 2,000 crore stuck in the aborted deal to buy Air Sahara, it is little wonder Edelweiss Securities has a clear sell on Jet. Since mid-July, Deccan Aviation has gained nearly 40%, Jet 19% and SpiceJet 18%, beating the BSE Sensex hollow (15%). The rally in aviation stocks is a bit premature, if not totally unreal.

The market may be celebrating the fall of high-priced oil a bit too soon. In the aviation sector, most listed stocks have rebounded from their lows, when in fact falling oil prices may have only a small impact on margins in a scenario of hyper competition. With the domestic sector continuing to attract new players - Indigo Airlines was the latest to launch in August - the new entrants will have no option but to offer steep discounts to build marketshare. This will force the incumbents to continue cutting prices, effectively neutralising the benefits of lower oil prices.

Between early 2005 and March, 2006, the total number of airline seats offered in the domestic market has risen 55%, forcing a fare war. But costs have risen faster, which makes any rerating of the sector impossible for now despite lower oil prices. A look at Jet Airways’ last quarter numbers shows why. Even though net revenues grew 25.6%, overall expenditures rose twice as fast at 53.7%.

A large part of this was due to fuel (about a third), but the fastest growing cost is not fuel, but employee remuneration, which more than doubled (up 106.5%) due to a ramp-up of operations. The story is likely to be much the same in the rest of the aviation sector, thanks to the induction of new aircraft, investments in ground handling, and higher payments for aircraft rentals. Lease rentals grew at a zippy 70.7% for Jet, even as other operating expenses have risen to account for a quarter of total costs.

There is thus a strong possibility that the fall in oil prices will be more than compensated by rising costs of personnel, aircraft lease rentals, and interest costs. Jet, for example, had to shelve its plans to make a $800 million GDR/FCCB issue due to unsettled market conditions, choosing instead to borrow more from domestic banks at higher rates. With more than Rs 2,000 crore stuck in the aborted deal to buy Air Sahara, it is little wonder Edelweiss Securities has a clear sell on Jet. Since mid-July, Deccan Aviation has gained nearly 40%, Jet 19% and SpiceJet 18%, beating the BSE Sensex hollow (15%). The rally in aviation stocks is a bit premature, if not totally unreal.