Investing

is most intelligent when it is most businesslike - Benjamin Graham (1894-1976)

____________________________________________________________________

Value-Stock-Plus stands at No. 50 in the

list of Top 100 Finance

Blogs by ValueWiki

Recognised by

The Economic Times as one of the most

popular financial blog

Updated! Compilation on

Warren Buffett,

Rakesh Jhunjhunwala

& Charlie Munger

____________________________________________________________________

« Home | Sensex & Gold: Golden highs » | The road less traveled » | Count on your strategies, not stars » | Are 20 Stocks Too Many? » | Market Risk & Time » | A nifty primer on the world of behavioural economics » | Buffett Succeeds at Nothing » | Are markets short term? » | Investing: A macro perspective » | It's A Mad, Mad, Mad, Mad, Market »

The best is yet to come, which will be triggered by a powerful confluence of the capex and the consumption cycle

by Rakesh Jhunjhunwala/DNA Money/ December 12th, 2005

Change is the only constant, says the Bhagvad Gita.

India has entered a phase of accelerated change. Over the last decade and a half, India has been transformed; but in the coming decade and a half, India will be an economic superpower.This change is evident in the relative share of market capitalisation, and is now being recognised.

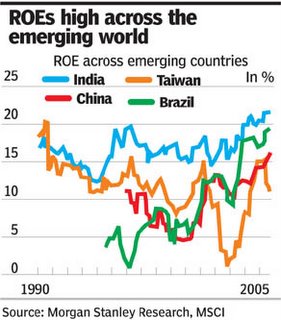

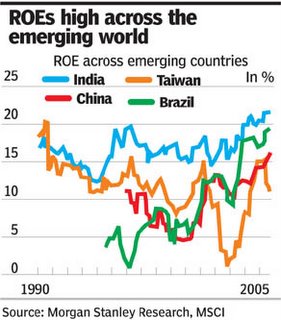

The genesis as well as essence of this change is reflected in the Indian equity markets as evidenced below. India Inc. has consistently recorded the best return on equity among emerging markets. The volatility of earnings is also the lowest among emerging market peers. It is vital to focus not only on the quantum of profits, but the quality of the profit improvements. The improvement in the quality of profits is permanent, as these profits are not driven by cyclical factors but by structural factors.

Much of this change is below the surface, but some of it is beginning to be visible now. The thought leaders are recognising this change, and the fact that the change has now gathered critical mass.

Let me enumerate some fundamental differentiating factors in India’s favour:

1. The change has happened after a due process of evolution, and is irreversible.

2. The change has happened in the face of a multitude of constraints, not restricted to infrastructure bottlenecks and government interference in business

3. The robustness of India financial system

4. The efficiency of India’s capital allocation

5. The superior incremental capital-output ratio (ICOR) of the Indian economy

6. Above all, a democratic environment with independent Judiciary that ensures longevity of wealth

Besides the quantum, the quality of this change is very impressive. The key parameters of this change are visible in many different dimensions and are flowing across to most sections of the economy. For example, the falling gross margins of corporates reflect greater consumer power, but economies of scale are enhancing shareholder value.

Over the past decade and a half, liberalisation and globalisation have transformed the economic landscape. The addressable opportunity for Indian corporates has expanded dramatically driven by access to global markets, while sourcing opportunities for global players have expanded due to their access to Indian corporates. This brings about scale, competitiveness, global best practices and inorganic opportunities.

The concentration ratios of most sectors of the economy are increasing, precluding the waste of fragmentation. The competitiveness of Indian corporates has undergone a sea-change, with quite a few Indian companies figuring amongst the global top 5 in their respective fields.

But the change in the mindset of India Inc is immeasurable, their confidence and attitude reflecting their aspirations and ability to handle complexity. Capital is no longer a constraint, and the imperative of skills is recognised.

There is a newfound respect for wealth, and for wealth creation. There is a virtuous cycle of consumption driven by better demographics, higher income, lower interest rates, better access to credit, and competitive pricing. But the best is yet to come, which will be triggered by a powerful confluence of the capex and the consumption cycle.

A new breed of businesses, and business models have been created in the past decade and a half like wireless telecom, information technology and IT-enabled services, and organised retail, among others.

A new breed of entrepreneurs has also been created - those that have demonstrated personal and organisational scalability as well as tremendous wisdom and integrity. These entrepreneurs are becoming idols and examples for a whole new generation - the likes of Narayana Murthy, Sunil Mittal and Kishore Biyani, among others.

But the change that is most stark is in the mindsets of the promoters: Improved corporate governance, the imperative of wealth creation, a willingness to dilute to optimise value, lower emotional entanglement with businesses, openness to outsourcing, pursuing new products, new markets and new consumers. However, all change brings with it attendant challenges and opportunities. Let me enumerate the opportunities and the challenges ahead of the New India Inc. as I see them.

Opportunities: India Inc is smartly using its skills and labour cost arbitrage for multifold expansion of an addressable market. Integrating into global supply chains by building a global delivery model can provide an orbit shift for Indian companies.

The opportunity available to corporates to leverage the advantages of a large domestic market can be a decisive advantage. The building of institutional frameworks across sectors is now ensuring a level playing field for all, in turn, liberating entrepreneurship from stifling bureaucracy, albeit slowly. There is a large global leadership opportunity for Indian companies and a few companies have already made decisive moves in that direction. Bharat Forge is on course to become the largest forging company in the world. Tata Motors is the fifth largest commercial vehicle manufacturer in the world. Indian information technology services companies are the fastest growing IT services companies in the world. Reliance is in the global top 5 in most of the business segments that it operates in.

Challenges: The most important challenge that Indian companies face is to avoid the past mistakes of capital mis-allocation and unrelated diversification. Increasing globalisation of the Indian economy poses new sets of challenges including cross-border transactions and cross-cultural operations. Competition and global competitiveness will be the key challenge that Indian corporates will have to face and overcome. India Inc. will continuously need to learn, re-learn and unlearn to keep evolving and to adapt to the dynamic environment. Growth and scale will give rise to larger execution risk and logistics complexity. Indian companies will also need to shape up for a more rigorous and prudent business modelling, financial planning and capital structuring.

However, attracting and retaining talent in the global market will be most challenging. The imperatives of creative destruction will have to be successfully navigated. The need to use the consequent wealth created for good social objectives is the most encompassing challenge.

To sum it all, the road ahead for India Inc is clear. It needs to remain focused and resist temptations, while upgrading its internal systems and processes. Indian corporates will have to graduate to multi-cultural, multi-location operations where the ability to attract and retain talent will be the key. The mindset needs to undergo a sea-change so that they conform to international regulations and legal framework along with multi-dimensional corporate governance. Above all, India Inc will have to continuously manage and exceed customer expectations in a global environment, while ensuring a sense of fairplay to all stakeholders. I am confident that India Inc will achieve this transformation, and play it’s central role in making India an economic superpower.

The best is yet to come, which will be triggered by a powerful confluence of the capex and the consumption cycle

by Rakesh Jhunjhunwala/DNA Money/ December 12th, 2005

Change is the only constant, says the Bhagvad Gita.

India has entered a phase of accelerated change. Over the last decade and a half, India has been transformed; but in the coming decade and a half, India will be an economic superpower.This change is evident in the relative share of market capitalisation, and is now being recognised.

The genesis as well as essence of this change is reflected in the Indian equity markets as evidenced below. India Inc. has consistently recorded the best return on equity among emerging markets. The volatility of earnings is also the lowest among emerging market peers. It is vital to focus not only on the quantum of profits, but the quality of the profit improvements. The improvement in the quality of profits is permanent, as these profits are not driven by cyclical factors but by structural factors.

Much of this change is below the surface, but some of it is beginning to be visible now. The thought leaders are recognising this change, and the fact that the change has now gathered critical mass.

Let me enumerate some fundamental differentiating factors in India’s favour:

1. The change has happened after a due process of evolution, and is irreversible.

2. The change has happened in the face of a multitude of constraints, not restricted to infrastructure bottlenecks and government interference in business

3. The robustness of India financial system

4. The efficiency of India’s capital allocation

5. The superior incremental capital-output ratio (ICOR) of the Indian economy

6. Above all, a democratic environment with independent Judiciary that ensures longevity of wealth

Besides the quantum, the quality of this change is very impressive. The key parameters of this change are visible in many different dimensions and are flowing across to most sections of the economy. For example, the falling gross margins of corporates reflect greater consumer power, but economies of scale are enhancing shareholder value.

Over the past decade and a half, liberalisation and globalisation have transformed the economic landscape. The addressable opportunity for Indian corporates has expanded dramatically driven by access to global markets, while sourcing opportunities for global players have expanded due to their access to Indian corporates. This brings about scale, competitiveness, global best practices and inorganic opportunities.

The concentration ratios of most sectors of the economy are increasing, precluding the waste of fragmentation. The competitiveness of Indian corporates has undergone a sea-change, with quite a few Indian companies figuring amongst the global top 5 in their respective fields.

But the change in the mindset of India Inc is immeasurable, their confidence and attitude reflecting their aspirations and ability to handle complexity. Capital is no longer a constraint, and the imperative of skills is recognised.

There is a newfound respect for wealth, and for wealth creation. There is a virtuous cycle of consumption driven by better demographics, higher income, lower interest rates, better access to credit, and competitive pricing. But the best is yet to come, which will be triggered by a powerful confluence of the capex and the consumption cycle.

A new breed of businesses, and business models have been created in the past decade and a half like wireless telecom, information technology and IT-enabled services, and organised retail, among others.

A new breed of entrepreneurs has also been created - those that have demonstrated personal and organisational scalability as well as tremendous wisdom and integrity. These entrepreneurs are becoming idols and examples for a whole new generation - the likes of Narayana Murthy, Sunil Mittal and Kishore Biyani, among others.

But the change that is most stark is in the mindsets of the promoters: Improved corporate governance, the imperative of wealth creation, a willingness to dilute to optimise value, lower emotional entanglement with businesses, openness to outsourcing, pursuing new products, new markets and new consumers. However, all change brings with it attendant challenges and opportunities. Let me enumerate the opportunities and the challenges ahead of the New India Inc. as I see them.

Opportunities: India Inc is smartly using its skills and labour cost arbitrage for multifold expansion of an addressable market. Integrating into global supply chains by building a global delivery model can provide an orbit shift for Indian companies.

The opportunity available to corporates to leverage the advantages of a large domestic market can be a decisive advantage. The building of institutional frameworks across sectors is now ensuring a level playing field for all, in turn, liberating entrepreneurship from stifling bureaucracy, albeit slowly. There is a large global leadership opportunity for Indian companies and a few companies have already made decisive moves in that direction. Bharat Forge is on course to become the largest forging company in the world. Tata Motors is the fifth largest commercial vehicle manufacturer in the world. Indian information technology services companies are the fastest growing IT services companies in the world. Reliance is in the global top 5 in most of the business segments that it operates in.

Challenges: The most important challenge that Indian companies face is to avoid the past mistakes of capital mis-allocation and unrelated diversification. Increasing globalisation of the Indian economy poses new sets of challenges including cross-border transactions and cross-cultural operations. Competition and global competitiveness will be the key challenge that Indian corporates will have to face and overcome. India Inc. will continuously need to learn, re-learn and unlearn to keep evolving and to adapt to the dynamic environment. Growth and scale will give rise to larger execution risk and logistics complexity. Indian companies will also need to shape up for a more rigorous and prudent business modelling, financial planning and capital structuring.

However, attracting and retaining talent in the global market will be most challenging. The imperatives of creative destruction will have to be successfully navigated. The need to use the consequent wealth created for good social objectives is the most encompassing challenge.

To sum it all, the road ahead for India Inc is clear. It needs to remain focused and resist temptations, while upgrading its internal systems and processes. Indian corporates will have to graduate to multi-cultural, multi-location operations where the ability to attract and retain talent will be the key. The mindset needs to undergo a sea-change so that they conform to international regulations and legal framework along with multi-dimensional corporate governance. Above all, India Inc will have to continuously manage and exceed customer expectations in a global environment, while ensuring a sense of fairplay to all stakeholders. I am confident that India Inc will achieve this transformation, and play it’s central role in making India an economic superpower.

The best is yet to come, which will be triggered by a powerful confluence of the capex and the consumption cycle

by Rakesh Jhunjhunwala/DNA Money/ December 12th, 2005

Change is the only constant, says the Bhagvad Gita.

India has entered a phase of accelerated change. Over the last decade and a half, India has been transformed; but in the coming decade and a half, India will be an economic superpower.This change is evident in the relative share of market capitalisation, and is now being recognised.

The genesis as well as essence of this change is reflected in the Indian equity markets as evidenced below. India Inc. has consistently recorded the best return on equity among emerging markets. The volatility of earnings is also the lowest among emerging market peers. It is vital to focus not only on the quantum of profits, but the quality of the profit improvements. The improvement in the quality of profits is permanent, as these profits are not driven by cyclical factors but by structural factors.

Much of this change is below the surface, but some of it is beginning to be visible now. The thought leaders are recognising this change, and the fact that the change has now gathered critical mass.

Let me enumerate some fundamental differentiating factors in India’s favour:

1. The change has happened after a due process of evolution, and is irreversible.

2. The change has happened in the face of a multitude of constraints, not restricted to infrastructure bottlenecks and government interference in business

3. The robustness of India financial system

4. The efficiency of India’s capital allocation

5. The superior incremental capital-output ratio (ICOR) of the Indian economy

6. Above all, a democratic environment with independent Judiciary that ensures longevity of wealth

Besides the quantum, the quality of this change is very impressive. The key parameters of this change are visible in many different dimensions and are flowing across to most sections of the economy. For example, the falling gross margins of corporates reflect greater consumer power, but economies of scale are enhancing shareholder value.

Over the past decade and a half, liberalisation and globalisation have transformed the economic landscape. The addressable opportunity for Indian corporates has expanded dramatically driven by access to global markets, while sourcing opportunities for global players have expanded due to their access to Indian corporates. This brings about scale, competitiveness, global best practices and inorganic opportunities.

The concentration ratios of most sectors of the economy are increasing, precluding the waste of fragmentation. The competitiveness of Indian corporates has undergone a sea-change, with quite a few Indian companies figuring amongst the global top 5 in their respective fields.

But the change in the mindset of India Inc is immeasurable, their confidence and attitude reflecting their aspirations and ability to handle complexity. Capital is no longer a constraint, and the imperative of skills is recognised.

There is a newfound respect for wealth, and for wealth creation. There is a virtuous cycle of consumption driven by better demographics, higher income, lower interest rates, better access to credit, and competitive pricing. But the best is yet to come, which will be triggered by a powerful confluence of the capex and the consumption cycle.

A new breed of businesses, and business models have been created in the past decade and a half like wireless telecom, information technology and IT-enabled services, and organised retail, among others.

A new breed of entrepreneurs has also been created - those that have demonstrated personal and organisational scalability as well as tremendous wisdom and integrity. These entrepreneurs are becoming idols and examples for a whole new generation - the likes of Narayana Murthy, Sunil Mittal and Kishore Biyani, among others.

But the change that is most stark is in the mindsets of the promoters: Improved corporate governance, the imperative of wealth creation, a willingness to dilute to optimise value, lower emotional entanglement with businesses, openness to outsourcing, pursuing new products, new markets and new consumers. However, all change brings with it attendant challenges and opportunities. Let me enumerate the opportunities and the challenges ahead of the New India Inc. as I see them.

Opportunities: India Inc is smartly using its skills and labour cost arbitrage for multifold expansion of an addressable market. Integrating into global supply chains by building a global delivery model can provide an orbit shift for Indian companies.

The opportunity available to corporates to leverage the advantages of a large domestic market can be a decisive advantage. The building of institutional frameworks across sectors is now ensuring a level playing field for all, in turn, liberating entrepreneurship from stifling bureaucracy, albeit slowly. There is a large global leadership opportunity for Indian companies and a few companies have already made decisive moves in that direction. Bharat Forge is on course to become the largest forging company in the world. Tata Motors is the fifth largest commercial vehicle manufacturer in the world. Indian information technology services companies are the fastest growing IT services companies in the world. Reliance is in the global top 5 in most of the business segments that it operates in.

Challenges: The most important challenge that Indian companies face is to avoid the past mistakes of capital mis-allocation and unrelated diversification. Increasing globalisation of the Indian economy poses new sets of challenges including cross-border transactions and cross-cultural operations. Competition and global competitiveness will be the key challenge that Indian corporates will have to face and overcome. India Inc. will continuously need to learn, re-learn and unlearn to keep evolving and to adapt to the dynamic environment. Growth and scale will give rise to larger execution risk and logistics complexity. Indian companies will also need to shape up for a more rigorous and prudent business modelling, financial planning and capital structuring.

However, attracting and retaining talent in the global market will be most challenging. The imperatives of creative destruction will have to be successfully navigated. The need to use the consequent wealth created for good social objectives is the most encompassing challenge.

To sum it all, the road ahead for India Inc is clear. It needs to remain focused and resist temptations, while upgrading its internal systems and processes. Indian corporates will have to graduate to multi-cultural, multi-location operations where the ability to attract and retain talent will be the key. The mindset needs to undergo a sea-change so that they conform to international regulations and legal framework along with multi-dimensional corporate governance. Above all, India Inc will have to continuously manage and exceed customer expectations in a global environment, while ensuring a sense of fairplay to all stakeholders. I am confident that India Inc will achieve this transformation, and play it’s central role in making India an economic superpower.

The best is yet to come, which will be triggered by a powerful confluence of the capex and the consumption cycle

by Rakesh Jhunjhunwala/DNA Money/ December 12th, 2005

Change is the only constant, says the Bhagvad Gita.

India has entered a phase of accelerated change. Over the last decade and a half, India has been transformed; but in the coming decade and a half, India will be an economic superpower.This change is evident in the relative share of market capitalisation, and is now being recognised.

The genesis as well as essence of this change is reflected in the Indian equity markets as evidenced below. India Inc. has consistently recorded the best return on equity among emerging markets. The volatility of earnings is also the lowest among emerging market peers. It is vital to focus not only on the quantum of profits, but the quality of the profit improvements. The improvement in the quality of profits is permanent, as these profits are not driven by cyclical factors but by structural factors.

Much of this change is below the surface, but some of it is beginning to be visible now. The thought leaders are recognising this change, and the fact that the change has now gathered critical mass.

Let me enumerate some fundamental differentiating factors in India’s favour:

1. The change has happened after a due process of evolution, and is irreversible.

2. The change has happened in the face of a multitude of constraints, not restricted to infrastructure bottlenecks and government interference in business

3. The robustness of India financial system

4. The efficiency of India’s capital allocation

5. The superior incremental capital-output ratio (ICOR) of the Indian economy

6. Above all, a democratic environment with independent Judiciary that ensures longevity of wealth

Besides the quantum, the quality of this change is very impressive. The key parameters of this change are visible in many different dimensions and are flowing across to most sections of the economy. For example, the falling gross margins of corporates reflect greater consumer power, but economies of scale are enhancing shareholder value.

Over the past decade and a half, liberalisation and globalisation have transformed the economic landscape. The addressable opportunity for Indian corporates has expanded dramatically driven by access to global markets, while sourcing opportunities for global players have expanded due to their access to Indian corporates. This brings about scale, competitiveness, global best practices and inorganic opportunities.

The concentration ratios of most sectors of the economy are increasing, precluding the waste of fragmentation. The competitiveness of Indian corporates has undergone a sea-change, with quite a few Indian companies figuring amongst the global top 5 in their respective fields.

But the change in the mindset of India Inc is immeasurable, their confidence and attitude reflecting their aspirations and ability to handle complexity. Capital is no longer a constraint, and the imperative of skills is recognised.

There is a newfound respect for wealth, and for wealth creation. There is a virtuous cycle of consumption driven by better demographics, higher income, lower interest rates, better access to credit, and competitive pricing. But the best is yet to come, which will be triggered by a powerful confluence of the capex and the consumption cycle.

A new breed of businesses, and business models have been created in the past decade and a half like wireless telecom, information technology and IT-enabled services, and organised retail, among others.

A new breed of entrepreneurs has also been created - those that have demonstrated personal and organisational scalability as well as tremendous wisdom and integrity. These entrepreneurs are becoming idols and examples for a whole new generation - the likes of Narayana Murthy, Sunil Mittal and Kishore Biyani, among others.

But the change that is most stark is in the mindsets of the promoters: Improved corporate governance, the imperative of wealth creation, a willingness to dilute to optimise value, lower emotional entanglement with businesses, openness to outsourcing, pursuing new products, new markets and new consumers. However, all change brings with it attendant challenges and opportunities. Let me enumerate the opportunities and the challenges ahead of the New India Inc. as I see them.

Opportunities: India Inc is smartly using its skills and labour cost arbitrage for multifold expansion of an addressable market. Integrating into global supply chains by building a global delivery model can provide an orbit shift for Indian companies.

The opportunity available to corporates to leverage the advantages of a large domestic market can be a decisive advantage. The building of institutional frameworks across sectors is now ensuring a level playing field for all, in turn, liberating entrepreneurship from stifling bureaucracy, albeit slowly. There is a large global leadership opportunity for Indian companies and a few companies have already made decisive moves in that direction. Bharat Forge is on course to become the largest forging company in the world. Tata Motors is the fifth largest commercial vehicle manufacturer in the world. Indian information technology services companies are the fastest growing IT services companies in the world. Reliance is in the global top 5 in most of the business segments that it operates in.

Challenges: The most important challenge that Indian companies face is to avoid the past mistakes of capital mis-allocation and unrelated diversification. Increasing globalisation of the Indian economy poses new sets of challenges including cross-border transactions and cross-cultural operations. Competition and global competitiveness will be the key challenge that Indian corporates will have to face and overcome. India Inc. will continuously need to learn, re-learn and unlearn to keep evolving and to adapt to the dynamic environment. Growth and scale will give rise to larger execution risk and logistics complexity. Indian companies will also need to shape up for a more rigorous and prudent business modelling, financial planning and capital structuring.

However, attracting and retaining talent in the global market will be most challenging. The imperatives of creative destruction will have to be successfully navigated. The need to use the consequent wealth created for good social objectives is the most encompassing challenge.

To sum it all, the road ahead for India Inc is clear. It needs to remain focused and resist temptations, while upgrading its internal systems and processes. Indian corporates will have to graduate to multi-cultural, multi-location operations where the ability to attract and retain talent will be the key. The mindset needs to undergo a sea-change so that they conform to international regulations and legal framework along with multi-dimensional corporate governance. Above all, India Inc will have to continuously manage and exceed customer expectations in a global environment, while ensuring a sense of fairplay to all stakeholders. I am confident that India Inc will achieve this transformation, and play it’s central role in making India an economic superpower.