by Parag Parikh/ ETBB

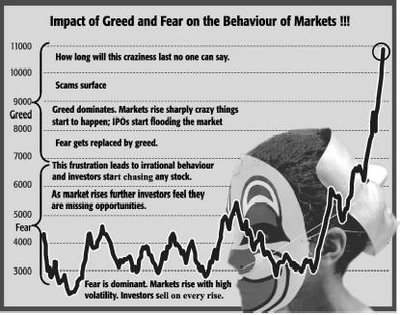

We all hear about Greed and Fear in the markets and today I wish to show you how markets behave when they are under these two emotional outbursts. In the early ’03, the sensex was at around 3000 when the Gulf War was going on.

There was fear all around and the market went to as low as 2800 in April /May ’03. At this time we were in the midst of a bear market and stocks were available at attractive valuations. Investors were so much struck by loss aversion that they preferred fixed income securities to stocks. And when the stocks started moving up investors started selling at every rise.

The reason was very simple. The memory of the dotcom crash was very vivid in their minds where they had seen stock prices crashing. This fear was so dominant that with every rise investors were selling their stocks.

Thus, the stock market was going up and the investors were slowly liquidating their stock portfolios. If we see the chart below we find that it took two and a half years for the index to go from 3000 to 7000 and because of fear observe the volatile ups and downs.

However, the market did not relent and still started moving up. This led to investor frustration. Rationality took a back seat and Fear was replaced by Greed. Since consistently investors were missing the upward rally they started entering the markets at any prices. That is the reason it took only seven months for the index to go from 7000 to 10000. And it has gone from 10000 to 11000 in just a month. This is how Greed works in the markets. In such times you see huge collections by the mutual funds.

Moreover, IPOs start flooding the market. It is happening at present. Different types of scams start surfacing. The dmat accounts and capital gains scams are the most recent ones. Banks and financers increase their margin lending lured by higher interest rates. Fixed income securities are ignored and investors greed makes them hunt for superlative profits. The exact opposite of early ’03 is happening now. Greed is dominant.

Investors see the private equity funds picking up stakes in companies at high valuations and mutual funds competing with each other to buy stocks at high prices. This makes the investors feel that they are missing the bus and they plunge in the market.

Here a word of caution for the investors: Following such institutional investors is a folly. They are investing other people’s money. There is a big difference in investing behaviour when one is investing one’s own money and when one is investing on behalf of others. When mutual funds start collecting huge monies it is a sign of a peak of bull markets. Wrong asset allocation takes place and the market crashes.

It happened during the time when Master gain and Master Plus collected record monies and the market crashed, same when Morgan Stanley Mutual Fund mobilised huge funds and the resultant market crash.

Even during the tech boom, we had some record collections in tech funds by some mutual funds and investors lost heavily as the markets crashed there after. We need to learn from history. At present we are seeing record collections by mutual funds. There is too much money around. Be fearful when others are greedy.

![]()