10 reasons for worry in the global markets

At the beginning of March, Merrill Lynch gave 10 reasons for worry in the global markets:

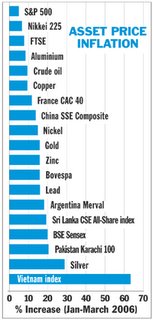

- Unsustainable year-to-date gains in markets like Brazil, Russia and Turkey. Can these markets really rise 300 per cent in 2006?

- Liquidity/carry-trade worries, as Bank of Japan exits its zero interest rate policy. Two-year Japanese Government Bond (JGB) yields have jumped to their highest level in five years.

- US GDP slowdown following this quarter’s very strong results (up 6 per cent now, could be up 2 per cent by September) — isn’t this what the 8 per cent year-to-date drop in Korean consumer disc-retionary stocks is telling us?

- Why robust global growth is not boosting commodity prices.

- A slump in treasury market volatility to levels not seen since July 1998 (eight weeks later, global emerging markets’ equities were down 30 per cent). Note the 10 per cent jump in volatility in recent days.

- Correlated assets, such as US oil and gas producers, undergoing a more pronounced correction than global emerging markets (GEMs).

- The world’s largest benefi-ciary of high commodity prices and ample liquidity, the Saudi Arabian market (up 600 per cent in three years), has fallen 10 per cent in three trading days. Does it indic-ate a flight to quality within GEM?

- Asian small caps, a good baro-meter of risk appetite, are strug-gling, with the KOSDAQ down 5 per cent year-to-date and JASDAQ down 11 per cent year-to date.

- The 2.4 per cent cash level of GEM long-only funds is still very low.

- Technical analysis starting to signal short-term ‘double-top’ in emerging markets.

The markets, of course, are oblivious to these warnings. Even the Saudi market recovered all its losses and closed in the black for the first quarter.

Source: Merill Lynch & Business World

interesting!

Posted by Anonymous |

6:29 PM

Anonymous |

6:29 PM